Peer to Peer Lending App Development: Transforming the FinTech Landscape

Introduction

The financial sector is undergoing a significant transformation thanks to technology. One of the most disruptive innovations is peer to peer lending app development, which bridges the gap between borrowers and lenders without the need for traditional banking institutions. P2P lending platforms provide users with a fast, easy, and cost-effective way to access or invest money. As demand for alternative lending continues to rise, developing a P2P lending app has become a profitable venture for startups and established businesses alike.

This article explores everything you need to know about building a peer to peer lending app—from core features and benefits to challenges, development steps, and the role of expert developers like Attract Group.

What is Peer to Peer Lending?

Definition and How It Works

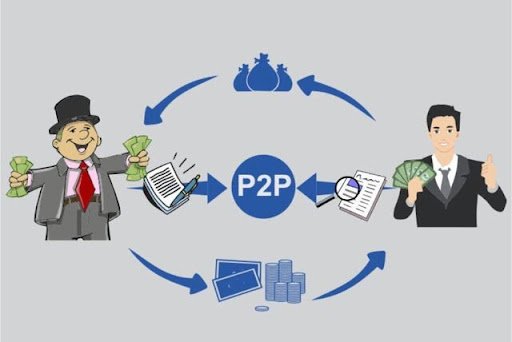

Peer to Peer (P2P) lending is a form of online lending where individuals or businesses borrow money directly from other individuals, bypassing traditional financial intermediaries. The platform acts as a marketplace, matching lenders looking for investment opportunities with borrowers in need of funds.

P2P lending apps streamline this process through intuitive interfaces, automated credit scoring, secure payment gateways, and data analytics. The platform earns by charging fees from both borrowers and lenders.

Why Invest in Peer to Peer Lending App Development?

Market Trends and Growth

The global P2P lending market is expected to exceed $1 trillion by 2030, driven by increasing internet penetration, a growing gig economy, and the need for accessible financing solutions. Traditional banks often reject loan applications due to stringent credit checks or lack of credit history. P2P lending apps fill this gap by using alternative data for borrower assessments.

Benefits of Developing a P2P Lending App

- Lower Operational Costs: No need for physical infrastructure.

- Higher Returns: Lenders can earn better interest rates than traditional savings.

- Faster Loan Approvals: Automated verification and scoring systems.

- Inclusive Finance: Enables underbanked and unbanked populations to access loans.

Core Features of a Peer to Peer Lending App

User Panel (Borrowers & Lenders)

- Registration and KYC: Secure onboarding and identity verification.

- Loan Application Module: Borrowers can input loan amount, purpose, and duration.

- Investment Dashboard: Lenders view available opportunities and returns.

- Credit Score Display: Risk analysis based on credit history and alternative data.

- Loan Repayment Schedule: Automatic reminders and EMI tracking.

Admin Panel

- User Management: Monitor borrower/lender activities.

- Loan Approval Workflow: Manual or automated checks.

- Analytics Dashboard: Performance metrics, default rates, and ROI.

- Dispute Resolution: Manage complaints and refund issues.

- Compliance Management: Stay aligned with legal frameworks (like KYC/AML).

Security Features

- Data Encryption

- Two-Factor Authentication

- Blockchain-based Smart Contracts (optional)

- Secure Payment Integration

Technologies Used in P2P Lending App Development

Backend

- Languages: Node.js, Python, Ruby on Rails

- Databases: PostgreSQL, MongoDB

- Cloud Hosting: AWS, Google Cloud, Azure

Frontend

- Frameworks: React Native, Flutter, Angular

- Cross-Platform Development: Ensures reach on both iOS and Android

Additional Technologies

- AI/ML: For credit scoring and fraud detection

- Blockchain: For decentralized lending and immutable records

- Big Data Analytics: To assess loan risk and optimize recommendations

Step-by-Step Guide to Peer to Peer Lending App Development

1. Market Research and Planning

Understand your target audience, regional regulations, and competitor offerings. Decide on a unique selling point (USP)—whether it’s better interest rates, speed, or inclusivity.

2. Choose the Right Development Partner

Selecting an experienced development team is critical. Attract Group, for example, specializes in fintech solutions, offering end-to-end support from idea validation to product launch. Their agile methodologies ensure timely delivery and scalable architecture.

3. UI/UX Design

User-friendly design is crucial for adoption. The app should be intuitive, responsive, and visually appealing, especially for non-tech-savvy users.

4. Development and Integration

- Build front-end and back-end components.

- Integrate APIs for credit scoring, payment gateways, and KYC.

- Implement robust security protocols.

5. Testing

Thorough testing ensures there are no bugs, security loopholes, or performance issues. This includes:

- Functional testing

- Security testing

- Load and performance testing

- Usability testing

6. Deployment and Launch

Deploy on cloud platforms for scalability. Launch beta versions, gather feedback, and fine-tune before full-scale launch.

7. Post-Launch Support and Maintenance

Regular updates, bug fixes, and feature enhancements are essential to retain users and remain compliant with changing regulations.

Legal and Regulatory Considerations

Every country has its own laws governing P2P lending. You must comply with:

- KYC (Know Your Customer)

- AML (Anti-Money Laundering)

- GDPR or local data protection regulations

- Financial Conduct Authority (FCA) for UK-based apps

- SEC regulations in the US

Partnering with a seasoned fintech developer like Attract Group ensures that these compliance requirements are considered from day one.

Common Challenges and How to Overcome Them

1. Trust and Security

Users are concerned about the safety of their money and data. Implement end-to-end encryption, regular audits, and transparent policies.

2. Loan Default Risk

AI-based credit scoring can reduce this risk by accurately assessing borrower reliability using both traditional and non-traditional data.

3. Regulatory Complexity

Working with experts who understand international and regional compliance is key to staying within legal boundaries.

4. Market Competition

To stand out, your app must offer:

- Unique features

- Better user experience

- Competitive rates

Why Choose Attract Group for Peer to Peer Lending App Development?

Attract Group is a trusted technology partner with extensive experience in building custom fintech solutions. They provide:

- Business analysis and planning

- UI/UX design tailored to fintech audiences

- Secure and scalable development

- Post-launch maintenance and support

With a portfolio of successful fintech products, Attract Group ensures your P2P lending app is not only technically sound but also market-ready and compliant with relevant laws.

Conclusion

Peer to peer lending app development is reshaping how people access credit and invest money. With the right development strategy and a reliable tech partner like Attract Group, you can create a feature-rich, secure, and scalable platform that stands out in the competitive fintech landscape.

As the demand for alternative finance grows, there’s no better time to invest in P2P lending technology. Whether you’re a startup or an established financial firm, building a P2P lending app could be your next big move in the digital finance revolution.